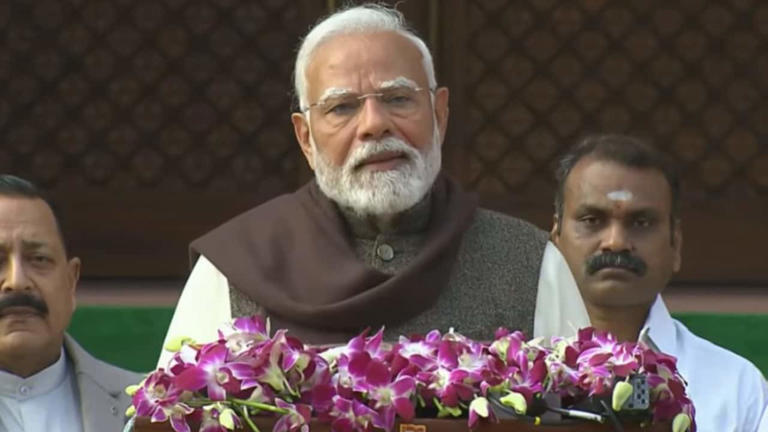

“Union Budget 2025: Tax Relief and Economic Support for Middle Class Expected as PM Modi Highlights Prosperity”

The upcoming Union Budget 2025 has sparked significant interest among taxpayers, particularly the middle class, following Prime Minister Narendra Modi’s recent address ahead of the Budget session. In his speech, the Prime Minister invoked Goddess Lakshmi, symbolizing prosperity, and emphasized the need for economic measures that benefit both the poor and the middle class. His remarks have heightened expectations of tax relief, economic support, and women-centric initiatives in the forthcoming financial plan.

With Finance Minister Nirmala Sitharaman set to present her eighth consecutive Budget on February 1, all eyes are on the government’s strategy to address key economic concerns, including slowing growth, rising living costs, and wage stagnation. The middle-class population, particularly salaried individuals, is keenly awaiting possible tax benefits, hoping for reductions in income tax rates and higher deductions.

As anticipation builds, reports suggest that significant revisions to the new tax regime could be on the horizon. The government, which has been actively promoting this regime, has already seen a 72% adoption rate among taxpayers. Among the rumored changes is a potential increase in the tax-free income limit to Rs 10 lakh, along with the introduction of a 25% tax slab for individuals earning between Rs 15 lakh and Rs 20 lakh.

The current income tax slabs under the new tax regime are structured as follows:

- Income up to Rs 3 lakh remains tax-free.

- Earnings between Rs 3 lakh and Rs 7 lakh are taxed at 5%.

- Those earning between Rs 7 lakh and Rs 10 lakh fall under the 10% tax bracket.

- The 15% slab applies to incomes ranging from Rs 10 lakh to Rs 12 lakh.

- A 20% tax rate is applicable to earnings between Rs 12 lakh and Rs 15 lakh.

- Incomes exceeding Rs 15 lakh attract a 30% tax rate.

If the proposed modifications are implemented, they could provide much-needed relief to middle-class taxpayers, easing their financial burden. The possibility of an increased exemption limit and revised tax slabs is expected to encourage greater compliance while boosting disposable incomes, ultimately fostering economic growth.

As India marks 75 years as a democratic nation, the government’s roadmap revolves around three core principles: innovation, inclusion, and investment. These pillars are expected to shape the policies outlined in the upcoming Budget. Given the economic challenges and aspirations of the middle class, the announcement on February 1 will be crucial in determining how the government plans to balance fiscal discipline with taxpayer-friendly reforms.

With the Budget session just around the corner, taxpayers and economists alike are eagerly waiting to see if the government delivers on its promises of economic relief and support for the middle class.