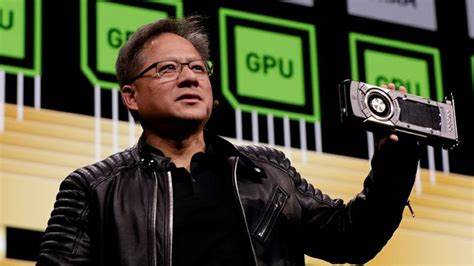

Investors are closely watching Nvidia’s earnings report scheduled for Wednesday after the market close. The performance of Nvidia’s GPU chips is critical to the thriving AI sector, which has been a major driver of the stock market’s recent gains. According to Wedbush analyst Dan Ives, this earnings report could be one of the most significant in recent years, given Nvidia’s central role in the AI boom.

Ives emphasized that the outcome of this report could greatly impact the stock market, describing it as potentially the “most important tech earnings in years.” For Nvidia’s stock to react positively, there needs to be strong enterprise demand for AI that supports tech sector growth, Ives noted.

Conversely, Deepwater Asset Management co-founder Gene Munster is less optimistic about Nvidia’s short-term performance. He cited potential delays with Nvidia’s next-generation Blackwell GPU as a possible negative factor. Munster also pointed out that Nvidia’s stock has risen 30% over the past three weeks and is nearing its all-time high, which could lead to a decline if the earnings report doesn’t meet expectations. Despite this, Munster believes the stock will recover quickly as investors adjust to the evolving AI landscape.

Treasury Partners CIO Richard Saperstein also highlighted Nvidia’s importance, noting that its earnings reports are always highly anticipated. The market expects Nvidia to demonstrate continued strong AI spending.

Additionally, Salesforce will report its earnings on Wednesday, offering another key insight into the tech sector’s health. According to Ives, Salesforce is expected to have a rebound quarter, reflecting a generally positive tech spending environment with a focus on AI.

Investors will also be keeping an eye on economic data releases this week. On Thursday, the weekly jobless claims report will provide updates on the job market, while Friday’s PCE Index release will offer insights into inflation trends, which could influence the Federal Reserve’s decision on interest rate cuts.

As the market heads into the final stretch of summer, it’s a crucial week for stocks, with the Dow Jones Industrial Average reaching new record highs on Monday morning.