Important Income Tax Changes in 2024 Every Taxpayer Should Know for 2025 ITR Filing

8 Crucial Income Tax Changes in 2024 That Taxpayers Must Know for ITR Filing in 2025

The Indian income tax framework has undergone significant updates in 2024, aimed at enhancing compliance and simplifying the filing process. These changes will play a key role in income tax return (ITR) filing for taxpayers in 2025. Here are eight pivotal amendments every individual taxpayer and business should be aware of:

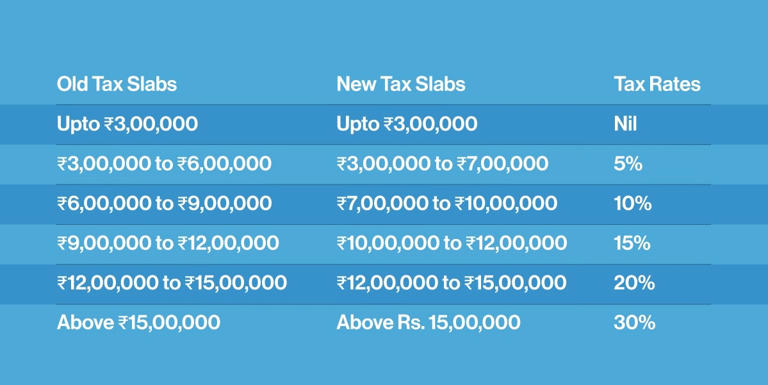

- Updated Income Tax Slabs Under the New Tax Regime

The revised tax slabs in the new regime aim to provide better savings for individual taxpayers, streamlining tax obligations. - Higher Standard Deduction Limit

The new tax regime raises the standard deduction from ₹50,000 to ₹75,000. For family pensioners, the deduction now stands at ₹25,000, up from ₹15,000. The old tax regime’s standard deduction remains unchanged. - Enhanced NPS Contribution Deduction

Employers’ contributions to the National Pension System (NPS) under Section 80CCD(2) now allow a deduction of up to 14% of basic salary, compared to the earlier 10%. - Increased Long-Term Capital Gains (LTCG) Tax Rates

The LTCG tax rate for specified assets, including equity shares and mutual funds, is now 12.5%, while the exemption threshold under Section 112A has been raised to ₹1.25 lakh from ₹1 lakh. - Revised Short-Term Capital Gains (STCG) Tax Rates

The tax rate for STCGs under Section 111A on equity shares, equity-oriented funds, and business trusts has been increased from 15% to 20%. - Reduced Capital Gains Tax on Immovable Property

For immovable properties, the LTCG tax rate is reduced to 12.5% (without indexation). Taxpayers can choose between this rate and 20% with indexation for properties bought before July 23, 2024. - New Holding Periods for Capital Gains

A uniform holding period of 12 months now applies to listed securities and 24 months to other assets for LTCG qualification. The holding period for bonds, debentures, and gold has been reduced to 24 months. - Increased Securities Transaction Tax (STT)

Effective October 2024, STT on equity derivatives trading has increased: from 0.0125% to 0.02% for futures and from 0.0625% to 0.1% for options. This affects the cost of trading in the derivatives market.

Taxpayers should understand these changes to make informed financial decisions for the upcoming tax season.